Limited liability is a business structure where a person’s financial status or liability where the corporate loss will not exceed the amount of investment in a partnership or limited liability. Limited liability is one of the advantageous things for investors. Which business form has the advantage of limited liability?

Limited liability and capital accounts

Some partnerships organize their partnerships just to retain liability to allow partners to only retain liability for payments of debts to the capital accounts in the business. Rather than requiring partners for personal whole debts and losses, it is a requirement of a partnership agreement to assume liability for the debts only for the extent of the capital of the business. Each partner begins with investing in their business and it grew in the share profit or whether they add further investment into capital.

It is an individual institution that legally owns one or more shares of a public corporation. Shareholders are not personally liable for the debts of the business or corporation. They possess limited consideration over debts and limited consideration for unpaid considerations owed by them to the business of the corporation. Creditors should not impose liability on shareholders, considering it as a whole legal entity. Creditors can sue the corporation for unpaid debts but cannot sue shareholders personally.

Limited liability entities

Limited liability entities are required to register their organization, where they held, where they operate under the laws of states as to hold in jurisdictions. The owners of these entities have many advantages of limited liability but before these, you need to conform to your corporation under state laws, otherwise, you are not liable to enjoy these advantages comes under limited liability.

Although in unlimited liability obligates shareholders and owners to cover the assets of liability personally of and organizations, where limited liability entities are not liable for involving personal assets of any individual. Limited liability partnerships, limited partnerships, and limited liability companies are three common forms of limited liabilities.

How does a limited liability company work?

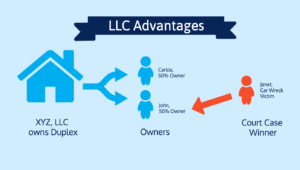

In short Limited Liability Company helps you to keep your personal finance away from paying debts and obligations of your company or business. Limited liability is a legal structure in which members of the corporation cannot be held personally for any liability.

An LLC enforces you to pay taxes; it is still profitable to pay your personal tax rather than paying the corporation’s taxes. A limited liability company is a hybrid business structure that is a combination of flexibility, simplicity, and tax advantages of a partnership within the liability of a corporation.

According to IRS today about 2.4 million businesses identify as LLCs and they are growing in numbers day by day faster than the rest of the business types. There are no specific conditions over the addition of members in an LLC.

If you have business partners or employees, an LLC protects you from personal liabilities. Limited Liability is a legal structure of organizations that limits the extent of economic loss.

The pros of limited liability

Limited liability:

Members of the corporation are not personally responsible for any actions of the corporation. This means the assets of members; like cars, homes, estate, etc. are under the protection of creditors. This protection is long-living, till you run your business. This helps to keep personal finances away from the business.

Pass-through federal taxation:

The profit of an LLC is a pass-through entity, which means its profit goes to all members of the corporation rather than profiting a single entity, and taxes on the company level rather than the individual. And if your business is facing some losses then you can lower your tax burdens with your members.

Management flexibility:

An LLC manages its members, which allows all owners to make day-to-day decisions on equal half. This is helpful for those people who do not have that much experience in business and it is hard for them to make decisions over what will be best for the business. Its management flexibility makes members important in the eyes of everyone.

Easy startup and upkeep:

The initial fee for an LLC paperwork is relatively light, though there is a wide variation in fees and taxes according to state to state. Besides these variations, this process is simple for owners to handle without special expertise, or you can consult a lawyer or an accountant in the case of help.

Which Business Form has the Advantage of Limited Liability?

There are some business organizational ones include advantages of limited liability the like following:

Partnership:

Compared to other business types es, the partnership is the job of minimal paperwork and includes less legal documents. There is no single superior and others are inferior, partners are combine expertise. All work is distributed among whole members.

Corporation:

A corporation is a business organization that acts as a separate entity from its members. A corporation pays its own taxes before distributing the profit among the members. There are certain advantages to members that they are not responsible for business debts and taxes.

Sole proprietorship:

This is the easiest business setup. There are no multiple owners. Just a single owner who is free to make his own decisions without asking for anyone’s consent. Even the tax reporting is easy in this business and the start-up is even costs low.

Co-operative:

A cooperative is a private business or an organization in which a group of individuals works for the same goal. The options of funding are greater, even the disruption is less.

Limited liability company:

Which business form has the advantage of limited liability? The most common form of a business for small businesses is a limited liability company. It is a defined separate legal entity. Even the management of the limited liability is flexible. All members are free to make choices regarding changes or some alterations in business.