How to close a corporation in California? Some corporations, run their business, gain profit. And sometimes face defeat and voluntarily the corporation decides to close the business. If you have reached that point to close your California corporation, then you need to look into some tasks.

Dissolving the Corporation

Your business is registered with the California state. Officially ending this business entity from the registry of states, and putting it beyond all claims. This is a task of dissolution. While a corporation is dissolving involuntarily, then it includes court decrees. This article is about voluntarily dissolved corporations. Dissolving a corporation voluntarily will involve special procedures. Only a corporation’s shareholders can decide the dissolution. It involves the consent and majority agreement of all shareholders.

California’s General Corporation Law (GCL) provides the laws for voluntary dissolution. If shareholders holding shares, at least voting over dissolving corporation should be 50%. The statutes of California State do not allow actions by the board of directors before the shareholder’s vote. The board of directors should call a meeting of shareholders and notify them about dissolutions. In case of dissolution, you should give an advance 10 days notice of vote over dissolution.

GCL allows you to avoid meetings of the shareholders, only if they have shares of less than 50%. If they hold more than 50% shares then they must have to sign over knowing as a ‘’consent’’ of each shareholder. However, you have no consent written then you can make a strict notice for those who did not sign for consent. This notice is known as ‘’prompt notice’’.

Winding Up

After approving the dissolution, your corporation continues to exist only to take care of the rest of matters. That collectively called winding up the corporation. Winding up includes the matter of remaining assets, paying debts, etc. The Corporation’s first obligations to take care of liabilities. The first liability is, paying business taxes and creditors. Other, then assets may be distributed to the shareholders. GCL provides, your board has the power to wind up and settle the affairs of your business.

Certificate of Election to Wind Up and Dissolve

If all the outstanding shares of your corporation vote in the favor of dissolution, then you don’t need to file a Certificate of Election to Wind up and Dissolve. With the Secretory of States (SOS). However, if the voting is less than required, then you can file for the certificate with SOS.

The certificate must provide this information:

- A statement that the corporation has elected to be dissolved.

- If the certificate is signed by a shareholder then it executes the statement.

- You can submit the certificate by mail or in person. There is no fee for the certificate sent by mail.

- The document handling fee should be handover to the SOS office.

Notice for Creditors and Claimants

Under GCL, the approval has been made for dissolution. Now you need to notify the creditors. This should be a written mail commencing a voluntary dissolution of a corporation. The winding-up to all creditors and claimants has been done. If you are not in the favour, consult your business attorney. This is to ensure that notices include all legally required information.

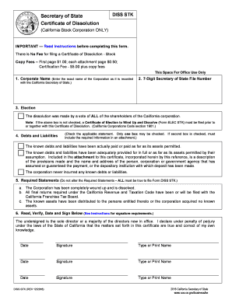

Certificate of Dissolution

After winding up your business, you must file a Certificate of Dissolution with the SOS. The certificate includes:

- A statement that ensures the corporation has been completely wound up.

- The corporation’s all known debts and liabilities should be successfully paid.

- Statement executing the corporation is dissolved.

- The instructions of Certificate of Dissolution, are available online too from the SOS websites.

- You can submit this certificate by main of in person. It does not acquire any kind of fees.

- In search of how to close corporation in a California? Be aware your business name will become available to use for other businesses after dissolution.

Some Important Notes

- Articles of incorporation must be filed within the last 12 months.

- Your corporation has no debts and liabilities left.

- Any existing tax liabilities and other liabilities will be satisfied. And assumed.

- Any final tax return will be filed with the Franchise Tax Board.

- If your corporation has not issued shares, and if the corporation has received payments for shares, those payments have been returned.

- Your corporation has not done any business.

- The majority of the directors authorized the dissolution.

- The assets have been distributed to the entitled person.

Clearance of Tax

The California State does not require to obtain tax clearance before the dissolution of the corporation. But as mentioned in the Certificate of Dissolution, you must affirm the final Franchise Tax Corporation.

Additional Information

How to close a corporation in California? Is for those who want to close the establishment of their corporation. Dissolving and winding up your corporation is the only process of closing. And you can find additional information on SOS websites.