The power of attorney is an integral aspect of long-term planning. Since all states recognise a power of attorney, the rules and regulations vary by state. A power of attorney authorises one or more individuals to serve as your lawyer on your behalf. The power may be restricted to a specific task, such as completing the selling of your property, or it may be applied broadly. The authority may be temporary or permanent. Giving others power of attorney (POA) gives them the authority to manage common financial issues on your behalf. Your lawyer, on the other hand, does not have the right to change your living trust or your power of attorney cannot change a trust if the POA agreement does not contain it.

What Is a Trustee Power of Attorney?

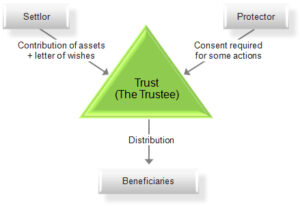

There may be times, though, when you choose to appoint the same person as both your trustee and your attorney-in-fact. A power of attorney (POA) is a document that allows some other person to act on your behalf. A trustee, on the other hand, is in charge of managing a trust.

Rights of a Power of Attorney?

Attorneys draught financial POAs to ensure that your agent has the privileges and powers you need. The following are examples of financial POAs:

1. Power of attorney for the general public. A general or daily POA grants your financial agent the authority to carry out typical POA transactions, such as tax filing and banking management. If you become incapacitated, this sort of POA will expire.

2. A durable power of attorney is one that lasts for a long time. This POA functions similarly to a general POA, but it remains in place even if you become incapacitated.

3. A special or limited power of attorney allows you to act on behalf of another. This POA has a particular function in mind, such as the selling of a home. Your agent’s ability to do things is restricted by special or limited POAs. These POAs may also define a time limit for the POA, such as two weeks when you’re out of the country. The privileges you have under a general or durable POA are determined by how your solicitor drafted the contract and the relevant state law.

4. The following are some of the traditional privileges that a financial POA has on behalf of the principal:

- submitting tax returns

- Participating in the banking industry

- Putting money into something

- Managing loans and paying bills

- Recruiting the best professionals, such as accountants and lawyers

- Making a claim for assistance

- Keeping track of the principal’s real and personal assets

- Bringing lawsuits on behalf of the principal

Your “agent” or “attorney-in-fact” is the person who is appointed in a power of attorney to work on your behalf. Your lawyer will act on your behalf as long as the power of attorney is accurate.

Is it Possible for Your Agent to Change Your Living Trust?

Can a power of attorney change a trust? If you want your agent to be able to make adjustments to your living trust or bank account beneficiaries, you must expressly grant these powers in your POA document. These powers can be listed in any form of the financial POA, but they must be clearly outlined or the agent would be unable to exercise them.

Your agent might be required to have both a POA contract and a trust agreement in order to adjust a living trust in certain states. Many states, on the other hand, allow an agent to alter a living trust if the power is only in the POA text. In other situations, after the POA gives the agent the authority to alter the trust, the agent may sign a release that the trustee must sign, allowing the agent to access the trust property.

It’s also possible to make your POA the trustee if you want your agent to manage financial matters within the trust. You can first be certain that your agent is absolutely trustworthy since they aren’t tracked until a case for mismanagement is filed against them.

Agent’s Role in Changing Your Living Trust

Can a power of attorney change a trust? If your representative has the authority to adjust your living trust, they will do so under such cases, such as in the event of a divorce, the death of a recipient, or the birth of a child. The POA will make adjustments if the justification is valid, as long as they are acting in your best interests. You can make your agent change your confidence in a variety of ways, including:

- Create a confidence amendment. An alteration form allows the agent to make a change to the trust agreement while keeping the rest of it unchanged.

- Restate the trust. This enables the agent to re-establish trust while still implementing changes. The trust remains unchanged during restatement, but it will obey the new trust agreement once it is in place.

- Resign your position of confidence. Since the agent must delete everything from the trust before applying the same property to the new trust, this is the least efficient choice. Since it requires more time, it causes more headaches than amending or restating the trust.

Regardless of how your agent modifies your confidence, it’s critical to enlist the assistance of an estate attorney. If you give your agent the authority to adjust your POA document’s confidence, make sure it’s done correctly by an experienced attorney.