A corporation could be a lawfully based mostly institution that’s separate and well-defined from its homeowners. firms fancy most of the rights and responsibilities that a personal firm enjoys. they will own assets, use folks, will take loans and borrow cash, will sue and be sued, and pay taxes. they will be thought of as a “legal person “.

Corporations

Corporations have some vital parts like liability, which suggests that each owner or we are saying shareowner encompasses a liability reckoning he/she has endowed within the corporation. Shareholders could participate in the profits created by the corporate through dividends and stock appreciation. However, they’re not in person chargeable for the company’s debt. Most of the well-known businesses within the world are firms. for instance, Microsoft Corporation, Google, Coca-Cola corporation, and plenty of additional.

To become an organization, an easy and direct procedure is concerned however, it varies from state to state or the state tend to reside in. the primary most typical issue is to use for an editorial of incorporation with the state and issue stock to the company’s shareholders. The shareholders can elect the board of administrators with mutual consent. A person may be concerned in additional than one business. once an individual is concerned in additional than one business or multiple businesses, the primary question that evolves in our mind is :

Can an organization own a corporation?

So, the solution to the present question is affirmative. Several entrepreneurs originated multiple firms to contour their taxes, to learn their shareholders, or to boost their company finances. Let’s get into details concerning all this. There are 2 most typical styles of the corporation that are:

(i) S- corporation

(ii)C- corporation

“S” and “C” firms just describe a federal tax election created by the corporation. They each principally lie the federal country.

-

S- Corporation

S firms are those corps that provide tax benefits and they will solely acquire up to one hundred shareholders. This helps to limit private liability for businesses and acquire company tax edges. Sometimes, the corporation directly passes financial gain to the shareholders’ accounts to avoid wasting themselves from double taxation. Filing underneath the S- an organization could be a very little additional long and additionally needs cash.

-

C- Corporation

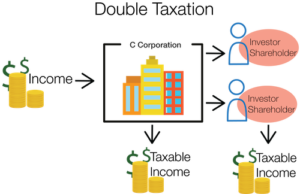

In this form of a corporation, the taxes are individually paid from the entity apart from shareholders or homeowners. These firms don’t have any limit on the number of shareholders. it’s the business structure that helps to set-up a fancy network of ventures during this corporation. it’s fewer limitations than S- firms.

S- corps and C- corps have several similarities however they’re different in their complicated technique of taxation and possession. C- corps are subject to double taxation whereas S- corps are pass-through tax entities, permitting them to avoid being taxed at the company level and once more on shareholders’ financial gain taxes. Once it involves company possession, C-corps haven’t any restriction on possession, which matches back to our purpose concerning them having unlimited growth potential.

However, S- corps do not have that luxury as they are restricted to no over one hundred shareholders. Also, S- houses can’t be owned by a C- corp, alternative S- corps, LLCs, partnerships, or several trusts. however, a chouse has no limits on who or what may be a shareowner. Compare firms and LLCs with our business comparison chart.

Which corporation can own any other corp or the other form of business?

S- firms have several restrictions relating to their possession. The shareholders may be the homeowners, however, they can’t embrace – non-resident voters and partnerships and firms. S- corp is that the organization that may own the other corps like C- firms, LLC, and others. Once an S- house owns a C- house, it provides flexibility that even helps in tax edges. Filing for C- corporation is a straightforward and painless procedure.

How to incorporate different corporations?

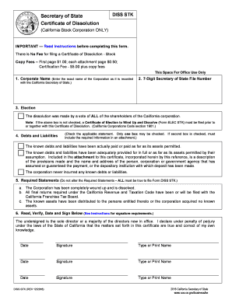

Basic steps that are concerned in incorporation are :

- Choose the name and address of the firm

- Choose the state within which the owner or promoter desires to include.

- Select the simplest form of the corp. for the business: LLC, S- Corp, or C- corp.

- Determine the board of administrators.

- Choose the share type: dividends, equity shares, or stock.

- After the clearance by the state, the certificate of incorporation may be obtained.

- The method and file the incorporation

Author’s Note

So, it may be simply finished that each style of firm principally has a constant procedure for incorporation. However, once it involves possession and tax edges, the S and C corps have different behaviours. And S- house will merely own C- house and even have the tax edges.