An annuity is a contract between an individual and an insurance company. In which one has to make lump-sum payments or a series of payments. This insurance company invests the funds of an individual. Annuities are contracts issued and sold by a specific insurance company. Primarily, an annuity is a financial product that pays a fixed amount to an individual as an income to retirees. The period, when an annuity is funded and the period when an annuity begins to payout is referred to as the accumulation phase. But many of the people ask; can you put an annuity in a trust?

Annuity and trusts

- As a financial asset, an annuity overall is a part of the financial estate plan of its purchaser.

- A trust is a fiduciary system. In which one person holds the property of another for the benefit of another. Then the grantor creates trust and transfer the document and transfers the trust.

- The grantor may create this trust for a lifetime or specific period until the shares are there.

- An annuity trust allows a person to set his property or estate to be managed through third party especially by the grantor. For the benefit purpose.

- The person who is creating the trust is referred to as a settler and the one who manages the trust is known as a trustee.

Types of annuity trusts

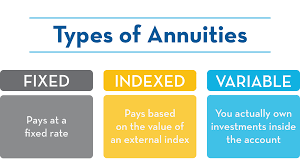

There are mainly three types of annuities:

- Fixed annuity

- Variable annuity

- Indexed annuity

Fixed annuity:

This option is granted as the least risk and the most predictable. Fixed annuities come with a guarantee, interest rate which does not vary beyond the terms of a contract. While other investments are unsteady while fixed annuity drives steady. However, the interest rate resets year to year but they do not fluctuate so frequently.

Variable annuity:

A variable annuity comes with greater risks and low predictability. As the risk is high, the reward will be high. Payments from variable annuities can increase if the shares portfolio does well. But if the portfolio does not work then it will create a great loss of money.

Indexed annuity:

Indexed annuities are also known as equity-indexed annuities. An indexed annuity has both the characteristics of fixed and variable annuities. It is a way to balance the risks and rewards which also carries lower risks and contain higher potential annuities. But the rate of its index can fluctuate according to the stock shares. The tradeoff is that this kind of annuity has higher costs and fees than a fixed annuity rate.

Other annuity choices

Can you put an annuity in a trust? There are numerous ways to design annuity for an individual. To include provisions for the owner and of the annuity and the beneficiaries. There are qualified and non-qualified annuities that refer to whether the annuity is regarding the qualified retirement accounts or taxation and withdrawal requirements. These options include:

-

Life-only annuities:

This is the annuity that pays through the length of annuitants and no longer. You can provide additional provisions to an annuity which can provide for your spouse or even a refund.

-

Life annuities with period certain:

It pays a certain number before the annuitant dies before the end of the period.

-

Joint and survivor annuities:

It provides payments over the lifetime of both the annuitant and the beneficiary.

How to put an annuity into a trust?

People create a trust for many reasons. Like trust can help pass assets to future generations after annuitants death. Conduct business activities and charitable giving. When you put trust into an asset, it changes the whole treatment you receive. Ownership of the annuity, we can put it into a trust. Only with consent of the annuitant. While an annuity is a contract between an insurance company and a living annuitant.

Assign ownership to trust

If you own an annuity and now you want to put an annuity into a trust, then simply assign the ownership into a trust. But the only annuitant can do this. The policy has a duration equivalent to the life of the annuitant, who is often the owner of the policy. If your intentions with putting an annuity into a trust are for profit, then you should put the beneficiary in an annuity too. The owner can specify a beneficiary to inherit proceeds after the death of an annuitant.

Beneficiary designations

Annuities are designed as a financial payment contract. Which continues proceeding after the death of an annuitant too. The beneficiaries, consider it as a lifetime investment. Your deposits will grow until you tell the company to start paying you back. If you die without getting payment back, the money will pass to your listed beneficiary. Putting an annuity in a trust will not involve the beneficiary designations into the contract. Before assigning ownership into the trust, make sure you listed beneficiary designations into the contract.

Summary

- Annuities are financial products, which offer guaranteed income streams, used mostly for retirees.

- Existence of an annuity firstly as an accumulation phase. Where investors fund the product with either lump-sum payment or periodic payments.

- The company begins paying out, once the annuitization period is reched. To the annuitant either in a fixed period or for the lifetime of an annuitant.

- Annuities are flexible for the annuitant. Structured into different kinds- variable, fixed, and indexed annuities