In the current age of continuous human advancement, fiscal and financial literacy is the need of the hour. Information about the various kinds of corporations is ingrained in the core concept of the above-mentioned literacy. First of all, to get started on the subject, the right step would be to get a brief idea about the various aspects in question. Can an LLC own a C Corporation?

What is an LLC?

LLC or Limited Liability Company is a form of a private limited company that effectively combines the crucial taxation attributes of a sole proprietorship. Or a partnership with the limited liability of a corporate entity. An LLC has a separate business identity from its owners. This means that it can open a bank account, perform transactions and file for taxes all on its own.

The most favourable attribute of an LLC that makes this venture a viable option in fact. That every member in an LLC has an identity separate from the company. This means that if the company goes bankrupt, the members are not obliged to pay off the creditors. Even if the amount recovered after selling its assets is not enough to settle the debts and liabilities. The creditors cannot legally hold the members responsible. Compared to other formats, an LLC need much fewer legal and financial courtesies, thus making it a practical choice.

When it comes to taxation, an LLC is not treated as a traditional tax entity like in the case of a corporation. Instead, it is seen as a ‘Pass-through entity’ or a ‘Flow through Entity’. This is similar to the tax procedure in a partnership or a sole proprietorship business where the income. And the losses directly seep through to the members, who then file it as their personal tax returns.

Although, this mandate is not rigid as the perspective changes depending upon the number of members in the corporation. In the case of a single member, LLCs are treated as a sole proprietorship for tax purposes and in the case of multiple members. LLCs are treated like a partnership where the profit and losses are distributed according to the percentage interest in the business.

What is a C Corporation?

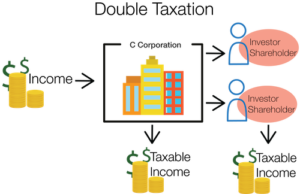

A-C corporation or popularly known as a C-Corp is a legal structure for a corporation in which the owners are taxed or seen as having a taxpaying identity separate from that of the corporation itself. While the prevalent burden of double taxation, both corporate and personal. Might seem harrowing but keeping in mind the aspect of ease of convenience makes it a good option. Just like an LLC, the personal liabilities of the different members of a C corporation are also controlled. Keeping the unbridled debt payback duties in check.

Another term that is almost antonymous to a C corporation is an S corporation. S corporation, also known as S Subchapter is a kind of entity that does not pay income tax. Instead, the profit and losses of the corporation are spread among the members which are then reported on their personal tax returns. Unlike C corporation, S corporation does not need to bear the burden of double taxation. This in turn leads to various other advantages like improved trust and personalized dedication to the company in the eyes of the public/investors.

C- corporation –

Despite having certain similarities in their attributes and functions. The members being able to enjoy the typically limited liability partnership privileges, absolute separate legal identity from the company and formative structure and components. There are certain differences between a C corporation and an S corporation.

Where a C corporation has its identity of being a separate taxable entity. An S corporation on the other hand acts like a ’Pass through’ tax entities. This unique characteristic of not having to pay income tax directly is the major point of difference between them.

Now, coming to the burning question,

Can an LLC own a C Corporation?

The answer is yes, an LLC can effectively own and control a C corporation. Here too, the ploy of an S Corporation should be given due consideration because although an LLC can own a C corporation. It cannot do the same thing in the case of an S corporation.

The deciding point of difference between these two entities which play an integral role in the decision-making process is that of tax filing. An S corporation is a small-scale business entity that acts as a ‘pass through. This gives it the power to steer clear of paying income taxes while the members have to bear the weight of the profit and the losses. Due to the fact of them being a ‘pass through, they also need to adhere to one important rule of thumb.

According to the rule, only individual people are allowed to own stock in an S corporation. This ‘pass through’ nature of an S corporation prevents the LLC from deciding to own it mainly due to the added hassle of having to pass the profits first through the S corporation and then again through the LLC. But in a true sense of disparity in the two types of entities being discussed. In a C corporation, both individuals and other business entities can own stock due to which an LLC can effectively own a C corporation if it wants to.

Proper attention –

While undergoing the process of purchasing a C corporation. Proper attention should be given to the various niches available to the LLC. They can either opt for full ownership of all the available assets in the C corporation. Or choose to own a handful of shares. In the case of a C corporation, the purchaser gets to enjoy certain conveniences. Like the ease of transfer of ownership and operations. Either way, the decision-making process is streamlined and made much easier. This is because the profitability opportunities of the purchasing LLC increase much more.in this case of purchasing the C corporation.