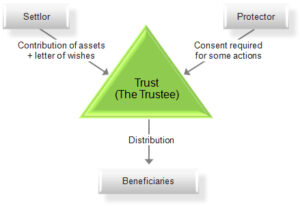

A trust is a legal partnership in which a person. It is a legal entity entrusted with the legal title to the property. It has a fiduciary obligation to retain and use it for the benefit of another. Trusts are created to provide legal protection for the assets of the trustor. To ensure that those assets are distributed according to the trustor’s wishes. Also to save time, prevent or decrease inheritance or estate taxes. Does the question arise that can trust be changed?

Parties involved in the formation-

- Settlor – The person or entity who establishes trust. Also called a Trustee or a Grantor.

- Trustee – An owner who has agreed to use his property for the benefit of another.

- Beneficiary – The owner of the Trust property who benefits from it.

Its Making Essentials-

- A written Trust Deed signed by the Settlor, a minimum of two Trustees, and two witnesses.

- The Trust’s Property (Money or Other Property).

- The Trusted Object/Purpose

- Stamp Paper, based on the value of the property held in trust.

- The deed must register with the Sub-office. Registrar’s Payment of registration fees for the apt.

- Trustee’s Name

- Trustee Address

- Apply for the trust’s permanent account number. Also, open a bank account for it.

- The trust may or may not be registered. Registration is required only if the trust receives an immovable property.

Several categories of trust-

Testamentary or a Living?

A living trust, also known as an inter-vivos trust. It is a written document that places an individual’s assets in trust for his or her use. It benefits during his or her lifetime. At the moment of the individual’s death, these assets are transferred to his beneficiaries. A successor trustee is in charge of transferring the assets to the individual.

A testamentary trust, also known as a will trust. It describes how an individual’s assets will be distributed after death.

Irrevocable or revocable contracts

The trustor will amend or revoke a revocable trust at any point during his life. As the name indicates, an irrevocable trust is one that the trustor cannot alter. Until it has been founded or one that becomes irrevocable upon his death.

Revocable and irrevocable living trusts exist. Only irrevocable testamentary trusts are possible. It is generally preferable to have irrevocable confidence. The fact that it is irreversible. It comprising assets that have been permanently transferred out of the trustor’s possession. It enables estate taxes to be reduced or prevented entirely.

A revocable trust can be changed-

- Most of us write multiple wills over the course of our lives. The conditions change, and our estate planning needs to adapt as well. A living trust, like a will, can be changed at any time. A revocable living trust’s flexibility is one of its most appealing features. You can change its terms or terminate it at any time.

-

In the case of Spouse-

Either, you or your spouse will rescind a shared trust you formed together. If you want to amend any trust clauses. Such as the beneficiary or successor trustee, you’ll need to agree in writing. And, in order to transfer real estate out of the living trust, both spouses will almost certainly have to sign transfer documents.

Consumers and title insurance firms typically require both spouses’ signatures on transfer documents. After one spouse dies, the surviving spouse may alter the terms of the trust document. They deal with his or her property. But, not the portions that decide what happens to the trust property of the dead spouse.

-

Traditional method-

When you want to make a change to your will. The traditional (and generally best) method is to rescind it completely and compose a new one. A living trust, on the other hand, presents a unique set of circumstances.

You don’t want to cancel the trust, make a new one, and transfer the property. Because you’ve already transferred the property to it. This is both costly and inconvenient. However, making changes to an existing document can be confusing.

-

Restatement-

The living trust document should be “restated” as a solution. To put it another way, you produce a new trust document. But you don’t cancel the old one. Instead, you restate it with some modifications. This allows you to retain the trust’s original date. It means you won’t have to do anything with the property already held in the trust.

An irrevocable trust can be changed?

Some irrevocable trusts include instructions to the trustees or beneficiaries. They enable the terms of the trust agreement. It serves as the trust’s formation document. They are changed under special and restricted situations. Some irrevocable trusts include instructions to the trustees or beneficiaries. It enables the terms of the trust agreement. It serves as the trust’s formation document, which changes under special and restricted situations.

Author’s Note –

The two main categories of trust, i.e. revocable and non-revocable or living and testamentary contradict themselves. Both are opposite of each other. They tell us whether that type of trust can be changed or not. It is easy to change a living or revocable. Whereas testamentary or non-revocable is difficult to change but some exceptions are always there.