Car Month to Month Rental Agreement is a lease that is specified with a certain duration. It can be cancelled or amended within a month. Here both landlord and tenant have the right to terminate the lease. But before terminating the lease, notifying the other party with proper notice is essential.

What is a month-to-month lease?

Month-to-month is an agreement between two parties that continues till 30 days or continues till one of the party terminate it. Adding any other thing, the lease can be changed after the completion of one month, the landlord can increase the amount of rent.

There are certain steps to know before assigning the car a month-to-month rental agreement. These are mainly for the background check:

Step I: Tenant’s credentials

When an individual is interested in a certain property upon a lease, they discuss the rent. The first move of the landlord should be a background check of the tenant. The landlord can check the tenant’s background through a rental application. This application allows the landlord to check the credentials of the tenant. Like it gives details about the individual’s credit report, verifies character potential, and criminal background.

Step II: Begin negotiations

At this moment, the landlord possesses all the credentials of the tenant. If he has a high-paying job and credit, then the owner can negotiate. But if the tenant has not that good job, then the owner could back off.

Step III: Tenant completes the rental agreement

If the tenant has viewed the property and both parties have made a verbal agreement over the vehicle on lease. Make sure one has to attach his FCRA (Fair Credit Reporting Act) to the final rental agreement of a car. It will be there for the detailing of the tenant’s rights. Once the written agreement is done, now tenant has to submit it to the landlord. While submitting an agreement, the tenant should return it along with the application fee.

Step IV: Writing the month-to-month lease

Upon completion of all negotiations and completing an agreement, the landlord and tenant should draft a lease. When the agreement expires, one should renew the lease. If the landlord wants to keep some changes in the lease, he can. Often renewing your lease would abide by the lease to go through statute. After the lease has been created, the tenant should carefully go through it, to ensure negotiated terms.

Step V: Executing the lease

After the landlord and tenant have agreed to the terms as included in the lease, the parties should execute all the conditions. The meeting has to be done over the car month-to-month rental agreement.

Tenant’s responsibilities

- Monthly payment

- Security deposit

- Rent proration amount on a fixed date

- Pre-paid rent

Landlord’s responsibilities

- Provide access to the vehicle

- Keep a copy of the executed lease

Step V: Taking occupancy

The tenant may now take occupancy over the property or vehicle. If the tenant has signed the terms of occupancy by a certain date. He isn’t subjected to leave a property.

Step VI: Terminating the month-to-month lease

The landlord wants to terminate the lease, he will require to send a notice. This notice is a termination letter. The notice must consist of occupancy and termination period. And the landlord should mention the reason for termination.

Step VII: Sending notice

It is recommended, to send a termination notice certified letter with a return receipt. If either party decides to terminate the lease, make sure to have some proof of receipt.

Contents to write in a Car Month to Month Rental Agreement

- Name of the landlord and tenant.

- Property description.

- Period of occupancy. Date of occupancy and date of termination.

- Amount of rent.

- Maintenance of vehicle.

- Mode of payment.

- Security deposit.

- If utilities are furnished by the landlord, such charges for utility.

- Facilities must be given to the tenant.

- Rules and regulations for usage.

- How tenant should handle requests in an emergency.

Common terms included in a rental agreement

- Rent: The consideration or payment made by the tenant to the landlord. In exchange, the landlord will handle the property to a tenant.

- Deposits: The amount of deposit required for occupancy.

- Usage: It is a purpose of the property. And other terms and conditions regarding the usage.

- Utilities: These are utilities included in the lease.

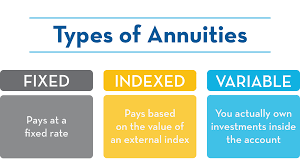

- Insurance: It is, whether the tenant is required to ensure the property. It is the most often used term.

- Maintenance: The responsibility of the maintenance will be on the tenant in the period of occupancy.

Security deposits in Car Month to Month Rental Agreement

In India, the tenant pays the security deposits and advance. The repaid must be done at the time of cancellation of the lease. It is supposed to be given to the landlord at the time of signing the contract. A part of a deposit can be used by the landlord. The landlord can use this deposit for the damages of a subject. Returning process is done at the cancellation or quitting of the contract.