When a tenant moves into a rental place, the most obvious expenses. That occur monthly or yearly is the rent to be paid. While moving in, the first and the last thing that matters to you is to pay the rent. So, think of the situation when the landlord refuses the rent payment, which serves as one of the income of the landlord. This made a tenant worry about the reason for doing so and whether it can cause eviction of the tenant. So, Can a landlord refuse rent payment?

There are some cases when this can happen as follows:

- If the tenant pays only part of the rent, the landlord can refuse to take it. As in most of the agreements, the clause to make a full rent payment is mentioned. There is always a specified amount mentioned to pay monthly. It depends on the landlord whether they take the amount of rent partially or not, which could be seen in the past. If they have no issues accepting late or partial payments. Then they cannot refuse payment unless they give the tenant a notice to make full payment only.

- If the landlord has given an eviction notice to the tenant unless tenants have meant to cover rental arrears. When the landlord issues an eviction notice. He/she definitely refuse to take the rent payment. This issue can only be solved if the tenant gives rental arrears.

- The lease agreement has come to an end and the landlord has given the notice to vacate the place and there is no chance to renew it. The landlord won’t be accepting any further rent from the tenant.

The tenant pays the rent through another method, other than mentioned in the agreement, the landlord won’t accept the rent payment. The landlord won’t be obliged if the tenant makes the payment through the wrong mode. For example, the tenant has an agreement to pay the rent in cash but he/she makes a cheque payment, the landlord has the right to refuse it.

If the landlord starts turning down the tenant’s rent payment, the tenant should be aware that he/she may not be evicted due to this. Sometimes, landlords try to get rid of the tenants and use these tricks as they can’t legally evict them. The tenants should be aware of their rights and play safe to prevent unlawful eviction.

Landlord-Tenant law

These laws vary from one state to another. But all of them try to protect the tenant from eviction without a cause. The notice of eviction can only be given in the following cases:

- The tenant has damaged the property.

- The continuous late rent payment.

- Any illegal activity performed in the rental unit.

- Violation of lease agreement more than once or twice and even not taken any preventative measures to stop or prevent them..

In these cases, the landlord provides the tenant with the “unconditional quit” notice. The tenant does not have any chance to make up with the landlord and can’t stay in the same unit. According to the state laws, the tenant has to timely pay the rent but what happens if the landlord refuses it`? As long as the tenant has not gone against the lease, their rights are safe. If they tried to pay the rent, he/she can prove that they have made the payment or at least tried them.

How to prove that the tenant has paid the rent?

In case the tenant has made the full rent payment on time without any delay and even if the landlord has not given any notice, then the tenant has to prove that he/she made a full attempt to make the payment. In order to collect proof, the tenant can send the rent payment via registered mail to the landlord’s address which is registered in the lease agreement. The mail option provides the document which provides the details of payment and when the landlord received it. If the landlord refuses the payment, that will also be recorded. This way the evidence can be shown in the court if anything happens.

No discrimination and no racism

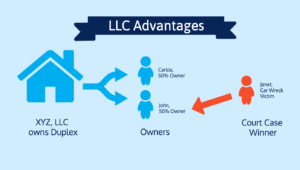

The landlord can serve an eviction notice without any cause, but sometimes it might be illegal. For instance, the landlord refuses rent payment to evict you because of the colour, caste, religion, status or any other. The eviction on the basis of discrimination and retaliation is illegal in mostly all countries and states. This method is illegal and the tenant has filed a lawsuit against the landlord and can take other necessary steps required.

Author’s Note-

The landlord can refuse rent payment only in case of partial rent payment, valid eviction notice, the term of lease agreement turns out or payment made in the wrong mode other than specified in the agreement. The tenant should make sure, he/she may not get evicted without any cause and illegally.